Now that I’ve successfully paid off my second targeted loan, I need a new payment strategy.

What I learned from the first strategy

Previously I was sending all my extra payments to 1 specific targeted loan in order to pay it off quickly. The strategy worked. I paid off the loan very quickly. More on that here.

During this time I was only paying the minimum due on the rest of my loans. The minimum due is less than the interest that accumulates every month. So the balance of each loan was growing a little. That sucks. I don’t want that to happen going forward.

However, the overall outstanding balance to Navient did go down because I was paying more in total towards the targeted loan, than the total interest accumulated across all my loans. Does that make sense?

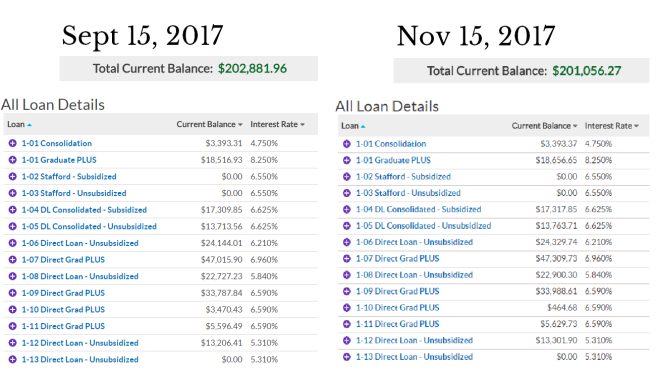

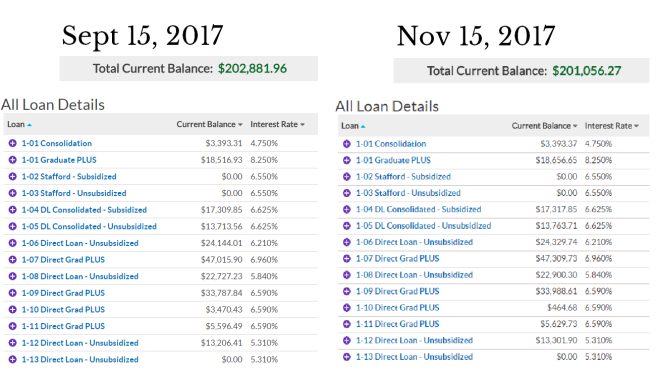

I know this image is tiny and a bit blurry, but let’s compare. The overall total balance went down. If you look at the individual balance of each loan, you’ll see they each went up. Except for loan 1-10, which was my targeted loan. I paid that loan off just after this screenshot. Sure I got the euphoric feeling of paying off a loan, but I think this strategy will ultimately cost more in the long run.

New Strategy

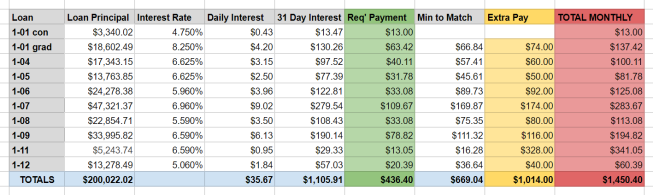

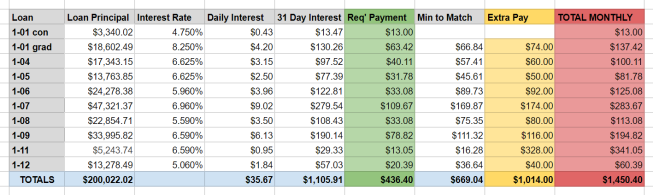

I want to pay off the total accumulated interest on each loan every month so that the balance of each loan does go up. To figure this out I created this chart (loan numbers from 12.8.17):

I calculated how much interest accrues each day (Daily Interest) and how much accrues over 31 days (I’m using 31 days as a default for a month). My loans accumulate $1.105.91 in interest every month.

I calculated how much interest accrues each day (Daily Interest) and how much accrues over 31 days (I’m using 31 days as a default for a month). My loans accumulate $1.105.91 in interest every month.

The green column is my current monthly required payment for each loan. I subtracted the Req’ Payment from 31 Day Interest to determine how much additional I need to pay towards each loan to pay all the interest every month. That comes to $669.04 additional every month.

Previously I had been paying an additional $1,000 a month on to my targeted loan. Now that it’s paid off I plan on continuing to pay an additional $1,000 a month plus the amount of the targetted loan’s monthly Req’ Payment, which was about $14 a month. For a total additional payment of $1,014 to Navient every month.

The yellow column on the above chart shows me rounding up the total additional amount I aim to pay on to each loan. I rounded up to whole, even numbers, so I don’t have to mess around with decimals, and since I make twice-monthly payments, I want those payments to also be whole dollar amounts.

However, for loan 1-01 con, I have decided not to make monthly additional payments, because the loan balance is the lowest, and the interest rate is the lowest. Though, in my 11.15.17 payment, I made an additional lump sum payment of $37.64 instead of tiny payment over a year. I could afford this because my final payment on loan 1-10 was less than my $500 normal payment.

I also have not evenly spread out the monthly additionally $1,014 across all 10 loans. I’m only rounding up a little for most loans, and putting a larger monthly payment towards loan 1-11. In a way, 1-11 is becoming my targeted loan for 2018.

To Conclude

The new plan for 2018 does two things: 1) Aims to not let interest accumulate on any loan; 2) Targets 1-11 for pay off in 15 months (on 2.15.19), barring any drop in additional payments. And hopefully, I’ll be able to pay more than this. Hopefully.

Fingers crossed.

I calculated how much interest accrues each day (Daily Interest) and how much accrues over 31 days (I’m using 31 days as a default for a month). My loans accumulate $1.105.91 in interest every month.

I calculated how much interest accrues each day (Daily Interest) and how much accrues over 31 days (I’m using 31 days as a default for a month). My loans accumulate $1.105.91 in interest every month.